How Professional Management Can Increase Property Values

October 1, 2025

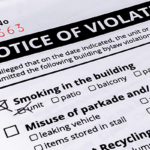

Common HOA Violations and How to Handle Them

October 13, 2025Money makes people crazy. That’s doubly true when it comes to HOA finances, where homeowners, collectively, hand over hundreds or thousands of dollars every year and sometimes feel like they’re throwing cash into a black hole. Board members know where the money goes, but if residents don’t understand the finances, you’re setting yourself up for conspiracy theories, angry meetings, and the kind of neighborhood drama that makes people want to move.

Financial transparency isn’t just about being nice to your neighbors. It’s about protecting yourself legally, making better decisions, and saving money in the long run. When residents trust how their money gets handled, everything else becomes easier.

What Happens When Money Goes Missing (Or Seems To)

Picture this scenario: Your HOA collects $500,000 in assessments every year, but residents continue to see the same broken streetlights, cracked sidewalks, and the same promises about fixing the pool “next year.” Where’s all that money going? Even if you’re spending every penny appropriately, it looks suspicious when people can’t see the connection between what they pay and what they get.

This perception problem creates real headaches for boards. Residents start showing up to meetings demanding answers, questioning every expense, and sometimes even calling for audits or board recalls. What began as a communication problem turns into a full-blown crisis that consumes time, energy, and often more money than simply being transparent would have cost.

Building Trust Through Open Books

Transparency doesn’t mean dumping a stack of receipts on residents and calling it good. It means presenting financial information in ways people can understand and use. Most homeowners aren’t accountants; they just want to know their money isn’t being wasted and that major expenses make sense.

Begin with regular financial reports that clearly explain what’s happening in plain language. Instead of just showing that $15,000 went to “landscape maintenance,” break it down: weekly mowing, seasonal plantings, tree trimming, irrigation repairs. When people see specifics, they understand value.

Annual budget presentations become opportunities to educate rather than defend. Walk residents through major expense categories, explain why costs are increasing, and show how reserve funds protect everyone’s investment. Answer questions before they become complaints by anticipating what people want to know.

Making Numbers Make Sense

Financial statements full of accounting jargon confuse more than they clarify. Smart boards work with their management companies to create reports that regular people can follow. Use charts, graphs, and comparisons that show trends over time rather than just monthly snapshots.

Show residents how their assessment dollars get divided; for example, 40% goes to landscaping, 25% to standard area maintenance, 20% to reserves, and 15% to administrative costs. Visual breakdowns, such as pie charts, help people better understand where their money goes than spreadsheets full of line items.

Compare your community’s costs with those of similar neighborhoods whenever possible. If your landscaping budget seems high, explain that your community has twice as many common areas as the development down the street. Context helps residents understand whether they’re getting good value for their investment.

The Reserve Fund Mystery

Nothing confuses homeowners more than reserve funds. They see thousands of dollars sitting in accounts “doing nothing” while their mailbox cluster needs repair, or the playground equipment looks tired. Explaining reserves requires patience, but it’s crucial for long-term financial health.

Help residents understand that reserves aren’t rainy day funds; they’re planned savings for known future expenses. The roof will need replacement, the asphalt will need resurfacing, and the pool equipment will eventually wear out. Reserve funds mean these predictable costs don’t require special assessments that shock everyone’s budget.

Publish a reserve study summary that shows what major components need replacement and when. When residents see that the community’s roofs have a 20-year lifespan and they’re already 15 years old, they understand why reserve contributions are increasing.

Special Assessments: The Transparency Test

Special assessments represent the ultimate test of financial transparency. When boards spring surprise bills on residents without adequate explanation, trust evaporates quickly. However, when communities are transparent about aging infrastructure and reserve fund shortfalls, residents understand why additional funding becomes necessary.

Document the decision-making process that leads to special assessments. Show residents what options were considered, why other solutions won’t work, and how the assessment amount was calculated. People might not like paying extra, but they’ll accept it if they understand the reasoning.

Give residents time to plan for special assessments whenever possible. A six-month heads-up about a roof replacement assessment shows more consideration than a 30-day notice, even if both meet legal requirements.

Technology That Opens Doors

Modern communities benefit from online portals that allow residents to access financial information at any time. Being able to check assessment payment history, review monthly financials, or download budget documents at midnight on Sunday makes information much more accessible than waiting for the next board meeting.

Digital transparency tools also create automatic documentation. When financial information is regularly posted online, there’s a clear record of what was shared and when, which protects boards if questions arise later about disclosure.

Avoiding the Perception Problems

Sometimes boards create transparency problems without realizing it, and holding financial discussions in executive sessions, being vague about vendor selection processes, or making major purchases without community input all fuel suspicions about financial management.

Exercise heightened vigilance concerning possible issues—conflicts of interest. If a board member’s business provides services to the community, document the bidding process thoroughly and consider recusing that member from related votes. Even legitimate transactions can look questionable without proper transparency.

Explain the reasoning behind financial decisions, not just the decisions themselves. When you choose a more expensive contractor, explain to residents why, such as a better warranty, faster completion, superior materials, or a proven track record in your community.

Professional Management Makes It Easier

Working with experienced management companies simplifies financial transparency because they’ve developed systems and reports that work. They know what residents typically want to see and how to present complex information.

Professional managers also provide independent oversight that reassures residents. When a third party handles day-to-day financial management, it reduces concerns about board members having too much control over community funds.

Good management companies proactively suggest transparency improvements based on their experience with other communities.

The Long-Term Payoff

Communities that prioritize financial transparency spend less time dealing with money-related conflicts and more time focusing on improvements and activities that enhance property values. Residents who understand and trust financial management are more likely to approve necessary assessments and support community investments.

Transparent financial management also attracts quality board candidates. People are more willing to volunteer when they know the community’s finances are well-managed and clearly documented. This creates positive cycles where good financial practices attract engaged leaders who maintain those practices.

Your community’s financial health depends on more than just balancing the books – it requires resident confidence in how those books are managed. Transparency isn’t extra work; it’s essential protection for your community’s financial future and your board’s peace of mind.

Ready to Build Financial Trust in Your Community?

Tired of fielding questions about where assessment money goes or dealing with residents who don’t trust your financial decisions? At Neighborhood Management, we help communities achieve financial transparency that fosters lasting trust and confidence.

Let us show you how clear financial communication can transform your community relationships. Contact us today to discover our transparent financial management approach, which keeps everyone informed and confident.